do you have to pay inheritance tax in kansas

If you received property from someone who died after July 1. To inherit under Kansas intestate succession statutes a person must outlive you by 120 hours.

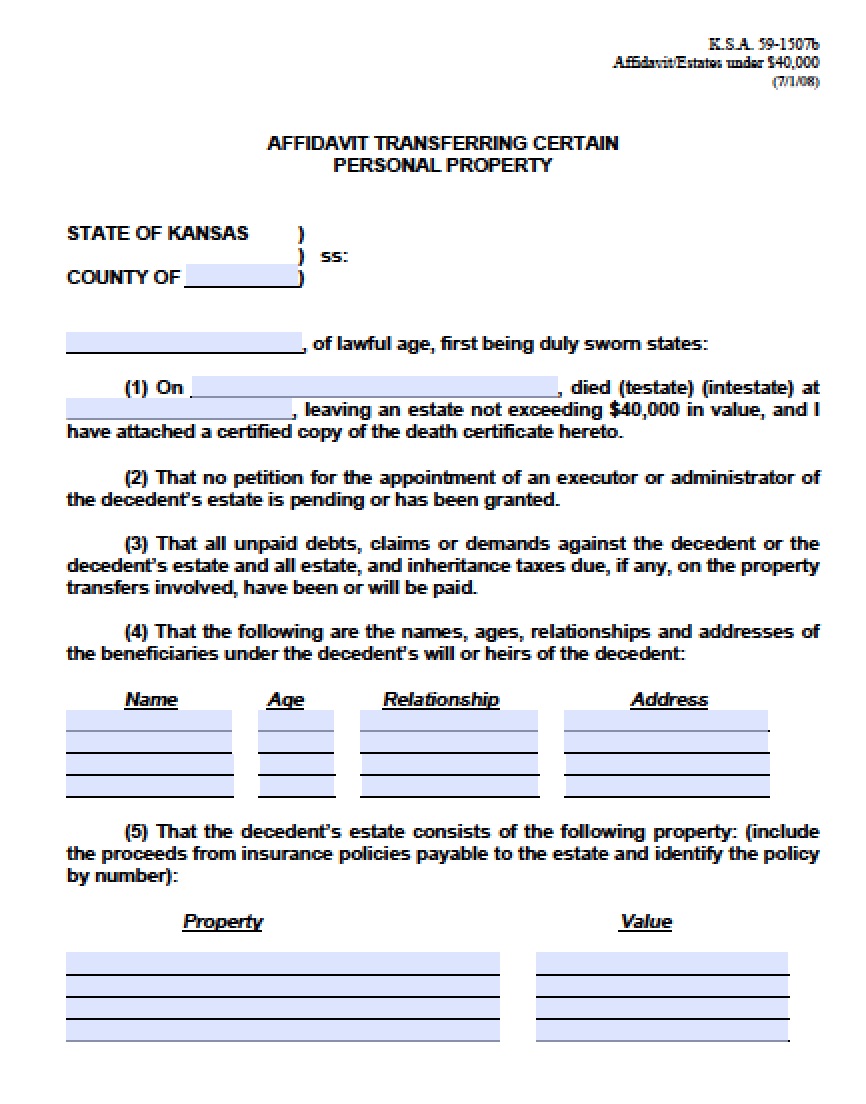

Free Kansas Small Estate Affidavit Form Pdf Word

In Pennsylvania for instance the inheritance tax applies to anyone inheriting property from a Pennsylvania resident even if the inheritor lives.

. If the inheritance tax is paid within nine months of date of decedents death a 5 percent discount is allowed. Whether or not you have to pay inheritance tax depends on the state you live in the size of the inheritance and your relation to the deceased. Kansas does not collect an estate tax or an inheritance tax.

Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. So if you and your brother are in a car accident and he dies a few hours after you do his estate would not receive any of your property. However if the beneficiarys net inheritance tax liability exceeds 5000 and the return is filed timely an election can be made to pay the tax in 10 equal annual installments.

The tax due should be paid when the return is filed. These states have an inheritance tax. If you want professional guidance for your estate plan SmartAssets free financial.

We have helped them obtain money to pay for the funeral burial medical bills credit card debt and everyday. This is a tax on the value of the estate to be paid by the estate. Inheritance tax rates differ by the state.

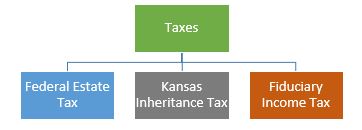

You may also need to file. Kansas inheritance and gift tax. There is no federal inheritance tax but there is a federal estate tax.

Up to 25 cash back In Kansas do you have to pay inheritance tax on money received through a person that does not have a will but goes through probate. The federal estate tax is calculated and paid before the estate is distributed to the decedents heirs. For example Kansas estate planning attorney Victor Panus says that surviving spouses are entitled to exempt property including household furnishings and one vehicleAdditionally the spouse and minor children are entitled to a family allowance of 35000 and a homestead exemption of 1 acre of a city.

The federal estate tax is calculated and paid before the estate is distributed to the decedents heirs. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax.

Inheritance tax is strictly a state-mandated process there is no taxation from the federal government on individual inherited items. There are not any estate or inheritance taxes in the state of Texas. Kansas residents who inherit assets from Kansas estates do not pay an inheritance tax on those inheritances.

We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. Inheritance Advanced has worked with more than 1700 satisfied clients across the country including state. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9.

At the federal level there is no tax on. Inheritances that fall below these exemption amounts arent subject to the tax. Kansas law provides several protections for surviving spouses.

Currently there are only six states in the United States that assess the tax. In 2021 federal estate tax generally applies to assets over 117 million. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

Residents of Kansas and Missouri will be happy to hear that your states are not included in the six. That is a recent tax law change 2010. State laws are constantly changing but here is a list of the currently listed states that are collecting estate tax or inheritance tax at a local level.

Up to 25 cash back Here are a few other things to know about Kansas intestacy laws. When faced with the death of a loved one we might not have much interest in inheritance-related issues however there are some financial practices that all should be aware of. Talking about less than the big figure of l00000 where you always read federal tax is non-existent for the big amount of inheritance.

Kansas has no inheritance tax either. The tax due should be paid when the return is filed. In this detailed guide of the inheritance laws in the Sunflower.

Like most states Kansas has a progressive income tax with tax rates ranging from 310 to 570. Kansas residents who inherit assets from kansas estates do not pay an inheritance tax on those inheritances. Do You Have to Pay Taxes on Inheritance.

Who has to pay. Kansas Inheritance and Gift Tax. In this detailed guide of the inheritance laws in the Sunflower State we break down intestate succession probate taxes what makes a will valid and more.

Another states inheritance laws may apply however if you inherit money or assets from someone who lived in another state. These two states are maryland and new. States including kansas do not have estate or inheritance taxes in place as of 2013.

You may also need to file some taxes on behalf of the deceased. Does kansas have an inheritance tax. We have already discussed the.

If you live in Kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it. If you are entering into the probate process in Kansas and you need cash immediately inheritance advanced is here for you. As of 2021 the six states that charge an inheritance tax are.

Not all states have an inheritance tax. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. Kansas eliminated its state inheritance tax in 1998 and has not reinstated an inheritance tax as of March 2013.

One question that confuses many is do you have to pay taxes on an inheritance This depends on a few. The state sales tax rate is 65. If you live in kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax And Inheritance Tax In Kansas Estate Planning

Kansas State Taxes Ks Income Tax Calculator Community Tax

Kansas Inheritance Laws What You Should Know

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Kansas State Taxes Ks Income Tax Calculator Community Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Kansas Inheritance Laws What You Should Know

Kansas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Kansas State Taxes Ks Income Tax Calculator Community Tax

Kansas Estate Tax Everything You Need To Know Smartasset

Does Kansas Charge An Inheritance Tax

Kansas Estate Tax Everything You Need To Know Smartasset

Estate Planning Attorney Leawood Ks 913 908 9113 The Eastman Law Firm