maryland student loan tax credit 2021

Complete the Student Loan Debt Relief Tax Credit application. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents Tax Year 2021 Only Instructions.

Student Loan Forgiveness Updates Next Steps For Qualifying Borrowers

Deadline for Maryland residents to claim 1000 student loan relief 12 days away.

. To be eligible for the Student Loan Debt Relief Tax Credit you must. If you are looking for an alternative tax year please select one below. This application and the related instructions are for.

The tax credits were divided into two groups of eligibility including. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents Tax Year 2021 Only Instructions. Compute the Maryland tax that would be due on the revised taxable net income by using the Maryland Tax Table or Computation Worksheet contained in the instructions for Forms 502 or.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the. This application and the related instructions are for. Australian income tax rates for 2021-22 and 2022-23 residents Income thresholds Rate Tax payable on this income.

In 2021 9155 Maryland residents received the Student Loan Debt Relief Tax Credit. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over 40000 Marylanders.

The new stimulus bill signed on December 21 2020 extends the ability for employers to make tax-free student loan repayment contributions for employees until 2025. Tax credit 2022. Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain amount of student loan debt may claim against the State.

In 2021 approximately 9000 Maryland residents received. 23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan. Maryland Student Debt Relief Tax Credit.

What is the Maryland Student Loan Debt Relief Tax Credit. Maintain Maryland residency for the 2021 tax year. Have incurred at least 20000 in undergraduate.

Are you thinking about the services of a debt negotiation company debt negotiation consolidation or a tax obligation debt relief firm maryland student loan debt relief tax credit. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least. From July 1 2022 through September 15 2022.

The site outlined that in 2021 close to 9000 residents of Maryland applied and received the tax credit. If the credit is more than the taxes you would otherwise owe you will receive a. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

The credit amount is limited to the lesser of the individuals state tax liability for that year of the maximum allowable credit of 5000 per owner who qualifies to claim the credit. There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit. To be eligible you must claim Maryland residency for the 2021 tax year file 2021 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate.

Approximately 9155 state residents received the credit in 2021 with people who attended in-state institutions receiving 1067 in relief and people who attended out-of-state. Those who attended in-state institutions received 1067 in tax credits while eligible.

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Will Borrowers Have To Pay State Income Tax On Forgiven Student Loans Wolters Kluwer

2022 State Tax Reform State Tax Relief Rebate Checks

Student Loans Here S Who May Pay Taxes On Forgiven Student Debt Cnet

Tax Credit 2022 Deadline For Marylanders To Claim 1 000 Student Debt Relief In 13 Days Washington Examiner

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Student Loans Here S Who May Pay Taxes On Forgiven Student Debt Cnet

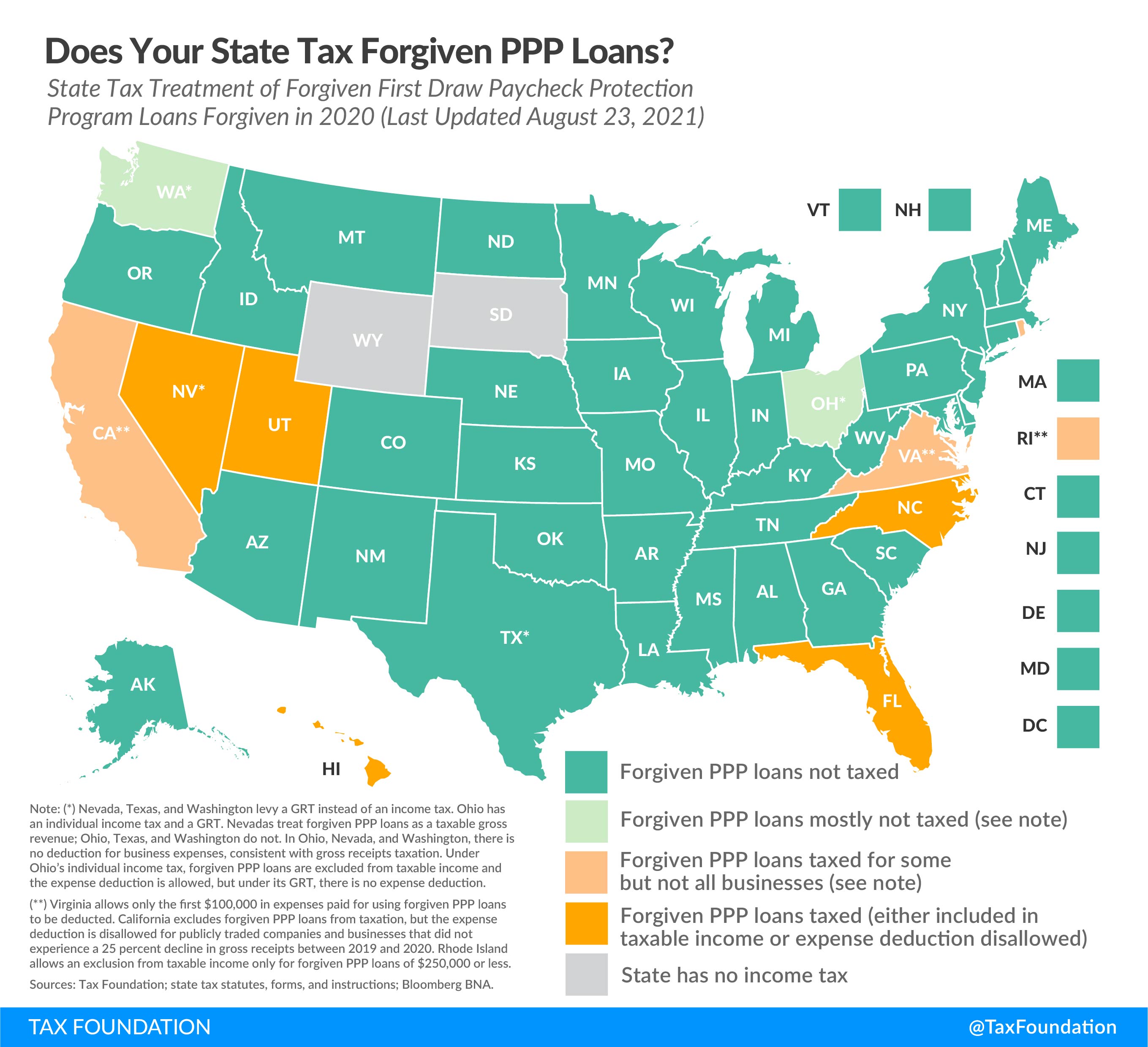

Ppp Loan Forgiveness Which States Are Taxing Forgiven Ppp Loans

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax Credit Wtop News

Maryland Student Loans Debt Statistics Student Loan Hero

Is Student Loan Forgiveness Taxable It Depends Conduit Street

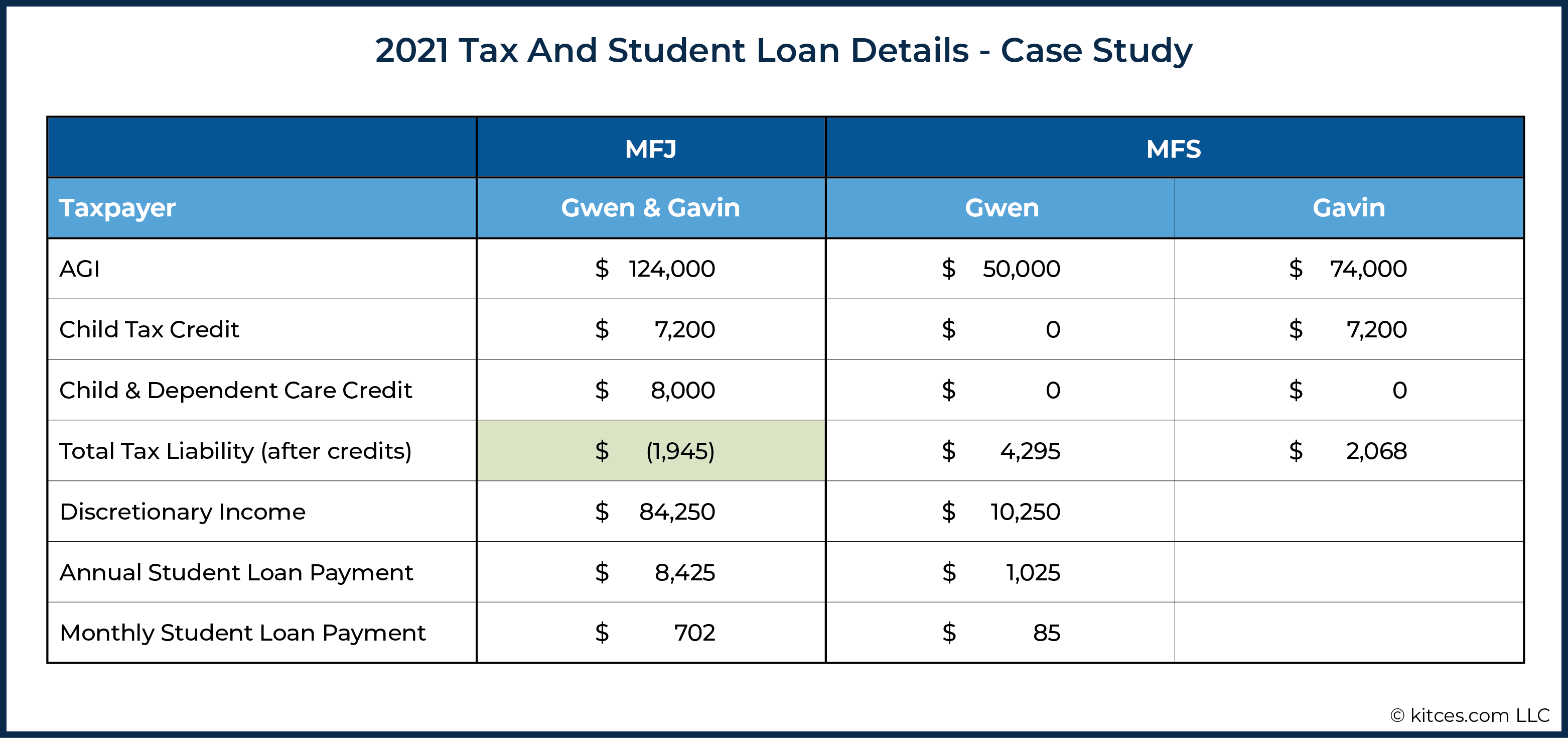

Income Recertification Planning As Student Loan Freezes Ends

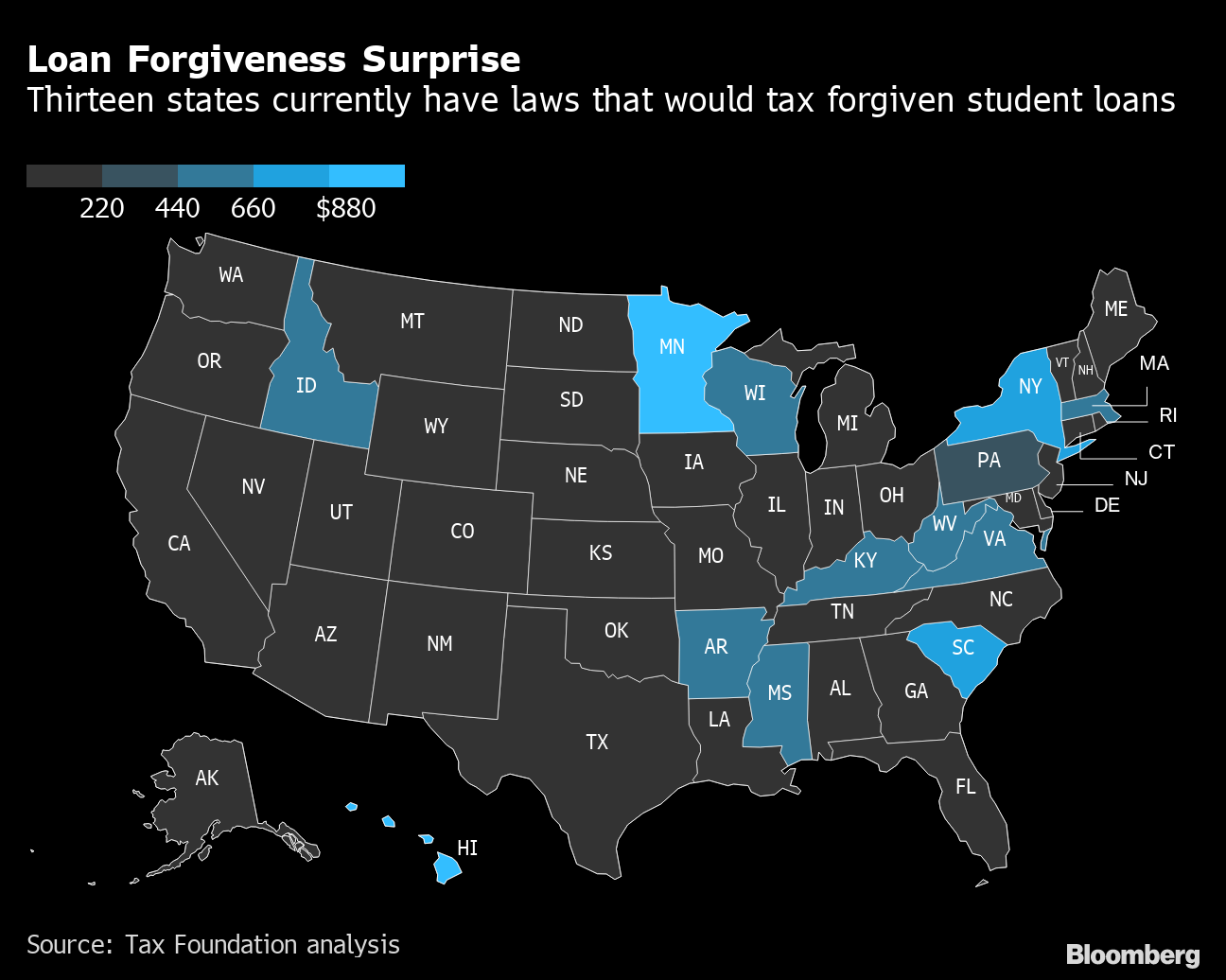

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

Navient Student Loan Settlement Who Qualifies For Relief And What To Do

Stopping Tax Offsets Due To Student Loan Debt

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Maine Expands Student Loan Tax Credit Marcum Llp Accountants And Advisors